Learning how to register a small business is the first step toward achieving your entrepreneurial dream. By breaking down the steps involved, you demonstrate your resolve to embark upon this exciting journey. And, by getting all the necessary paperwork done, and in the right way, you can move on confidently to the fun part: growing your business!

Generally speaking, the relevant paperwork falls into three essential categories: registration, taxes and compliance. Here’s a quick primer on what you need to know and how to get started.

Research naming and registration requirements.

Before making things official, you need a new name for your small business…

The name you select will appear on all official documents, on signage inside and outside your physical location (as applicable) and through all of your marketing and advertising efforts. Therefore, step one is undertaking a name availability search to ensure you don’t duplicate an existing name.

VistaPrint Tip

This handy trademark electronic search system will help keep you from choosing a name for your small business that’s already claimed or in use.

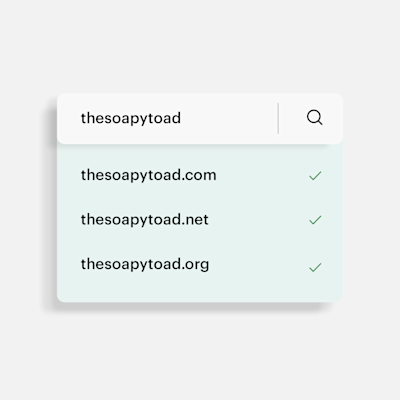

With a name on hand, the Small Business Administration (SBA) notes there are four distinct methods for registering that name. An entity name safeguards your business at a state level, while a trademark does the same at a federal level. Some states may require a “doing business as (DBA)” indication, and a domain name serves to guard your business website address.

Registering a small business name through a county clerk’s office or state government office is a necessary first step for an LLC business. Many businesses don’t have to register with the federal government, beyond filing for a federal tax ID. For trademarks, consult the U.S. Patent and Trademark Office after your business is formed.

Your business must obtain an Employer Identification Number in order to pay federal taxes, hire employees and apply for necessary permits and business licenses.

Other key tips:

- Register your business as a sole proprietor, partnership, LLC or existing corporation.

- Register your business with the appropriate secretary of state (application forms are often available on the secretary of state’s website).

- Select your “state of domicile,” which is often your home state.

- Designate a “registered agent address,” which is a place to receive and store legal documents and official notices. Some businesses opt to use a professional registered agent service.

Be aware of your small business tax obligations.

Regardless of your industry, certain tax obligations are the same across the board. As the SBA notes, your action steps include:

- Select a tax year, usually the same as a calendar year.

- Determine your state income tax requirements, based on your business structure.

- Prepare for federal tax obligations, including income tax, self-employment tax, estimated tax, employer tax and excise tax.

If employees make up part of your business, it’s necessary to pay state employment taxes (which are often different from one state to another). This generally includes unemployment insurance taxes, workers’ compensation insurance and temporary disability insurance. If withholding taxes from employee paychecks is mandatory in your situation, consult the Internal Revenue Service to determine which taxes you must withhold.

VistaPrint Tip

Launching a new business? Consult this small business start-up checklist to ensure you’ve addressed every step and are ready to bring your venture to life.

Follow compliance rules to strengthen your business.

Several factors go into determining the level of compliance required for your business. Much depends on the type of business, the state in which business is primarily conducted and the industry in which your business is categorized. In general, businesses are required to file an annual or biennial report, pay an annual franchise tax and/or pay required filing fees.

If your business falls under the domain of a federal agency, certain federal licenses and permits must also be obtained.

On a state level, county or city level, business licenses will differ. According to the SBA, “States tend to regulate a broader range of activities than the federal government,” so it’s critical that you research relevant state, country and city regulations. Make note of possible expiration dates for some permits and licenses, seeing as it’s preferable (in terms of time and resources) to renew key documentation rather than start all over again.

Some businesses are obliged to have employees acquire professional or occupational licenses (such as attorneys licensed by a state bar association). Research your own state’s licensure requirements in order to remain legally compliant.

Classifying the individuals who work for you is another “must-do” element of registering a small business. They must be designated either as “employees” or “independent contractors,” and these classifications will determine your compliance with employment and labor laws. Again, these requirements vary from state to state, so take the time to confirm.

Check to see if your state requires that your business:

- Pay Social Security taxes at the same level as employees.

- Provide workers’ compensation insurance.

- Offers disability compensation.

- Maintain compliance with the Family and Medical Leave Act, as well as the Affordable Care Act.

- Adhere to the Fair Labor Standards Act, governing regulations around minimum wage, overtime pay and related matters.

Finally, plan to keep your business free of discrimination and workplace harassment. These policies should be clearly laid out, so employees understand their options and a process exists to investigate any allegations along these lines.

Learning how to register a small business, as well as gathering information about taxes and compliance, sets you on the path toward success as a full-fledged business owner.

FAQs about registering a small business

1) What does it mean to “register” a small business, and why does it matter?

Registering a business usually means making your business official with the right government entities so you can operate legally, handle taxes correctly, and reduce personal risk depending on your structure. It can also help with practical steps like opening a business bank account, applying for financing, and building credibility with customers.

2) How do I choose the right business structure before I register?

Your structure (like sole proprietorship, partnership, LLC, or corporation) affects taxes, liability protection, and paperwork requirements. Many new owners start by mapping their risk level (e.g., client work vs. products), whether they’ll have partners, and how they plan to grow—then confirm requirements with official local/state resources or a qualified advisor.

3) What’s the difference between registering a business name, a DBA, and a trademark?

These steps often get confused:

- Business registration makes the entity official for legal/tax purposes.

- A DBA (“doing business as”) lets you operate under a name that isn’t your legal entity name.

- A trademark helps protect brand names/logos in commerce (separate from forming the business).

Which ones you need depends on how you’re naming and marketing the business.

4) What permits, licenses, and compliance tasks commonly come up after registration?

Many businesses need follow-on steps like obtaining relevant permits and licenses, setting up tax compliance, and creating basic workplace policies if hiring (including clear anti-discrimination/harassment expectations and reporting processes). Requirements vary widely by location and industry, so it’s worth building a checklist early.

5) What related steps should I plan alongside registration: banking, bookkeeping, insurance, and branding?

Registration is just one piece of the launch puzzle. Common adjacent steps include setting up business banking and bookkeeping, exploring insurance, and establishing a clear brand identity (name, logo, website) so you look legitimate from day one—especially when you start marketing and selling.